中国石化新闻网讯 据离岸能源网站6月20日报道,伍德赛德能源公司已经做出了在墨西哥开发大型高质量Trion项目资源的最终投资决定。计划于2028年开采第一批石油。

伍德赛德作为运营商,拥有60%的参与权益,墨国油PEMEX持有剩余的40%。

预计总资本支出为72亿美元(伍德赛德股份48亿美元,包括墨国油约4.6亿美元的资本结转)。预计该投资的内部回报率(IRR)将超过16%,投资回收期不到四年。不包括资本结转的预测内部收益率大于19%。

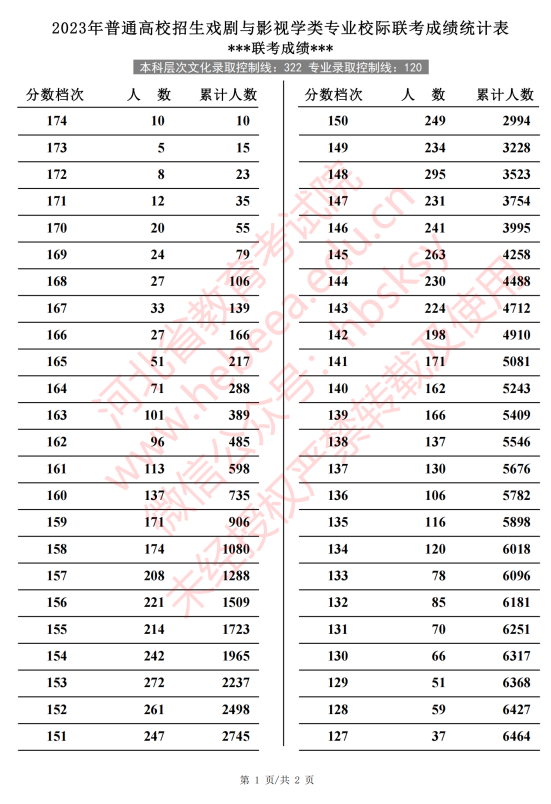

(相关资料图)

(相关资料图)

该资源将通过一个浮式生产装置进行开发,其石油日产能为10万桶。该装置将连接到一艘容量为95万桶石油的浮式储卸船(FSO)上。

Trion位于水深2500米,距离墨西哥海岸线约180公里,墨西哥/美国海上边界以南30公里处。Trion是墨国油于2012年发现的。必和必拓石油于2017年收购其一项权益,随后于2022年成为伍德赛德投资组合的一部分。

Trion的开发将包括安装一个浮式生产装置和浮式储卸船以及在初始阶段的18口井(9口生产井、7口注水井和2口注气井),在Trion项目的整个生命周期内总共钻了24口井。预计总资本支出为72亿美元,包括所有24口井。未回注或未在浮式生产装置上使用的天然气将运往墨西哥市场。

伍德赛德首席执行官梅格·奥尼尔表示,“Trion是伍德赛德在墨西哥湾优质生产资产组合中的一个有吸引力的补充。Trion是一种具有成熟开发理念的宝贵资源。我们强大的资产负债表和严谨的方法使我们能够投资于Trion项目,扩大我们的全球投资组合并提供长期价值。这一开发利用了伍德赛德在深水项目执行方面成熟的专业知识”。

梅格·奥尼尔表示,“我们已经考虑了一系列石油需求预测,相信该项目可以帮助满足世界的能源需求。三分之二的Trion资源预计将在启动后的前10年内生产出来”。

郝芬 译自 离岸能源网站

原文如下:

Woodside Makes FID in Trion Development, Mexico

Woodside has made a final investment decision to develop the large, high-quality Trion resource in Mexico. First oil is targeted for 2028.

Woodside is operator with a 60% participating interest and PEMEX holds the remaining 40%.

The forecast total capital expenditure is US$7.2 billion (US$4.8 billion Woodside share including capital carry of PEMEX of approximately US$460 million). The investment is expected to deliver an internal rate of return (IRR) greater than 16% with a payback period of less than four years. The forecast IRR excluding the capital carry is greater than 19%.

The resource will be developed through a floating production unit (FPU) with an oil production capacity of 100,000 barrels per day. The FPU will be connected to a floating storage and offloading (FSO) vessel with a capacity of 950,000 barrels of oil.

Trion is located in a water depth of 2,500 meters, approximately 180 kilometers off the Mexican coastline and 30 kilometers south of the Mexico/US maritime border. Trion was discovered in 2012 by PEMEX. BHP Petroleum acquired an interest in 2017 which subsequently became part of Woodside’s portfolio in 2022.

Development of Trion will include the installation of an FPU, an FSO, and 18 wells (nine producers, seven water injectors and two gas injectors) drilled in the initial phase, with a total of 24 wells drilled over the life of the Trion project. The forecast total capital expenditure of US$7.2 billion includes all 24 wells. Gas that is not reinjected or used on the FPU will be shipped to the Mexican markets.

Woodside CEO Meg O’Neill said Trion is an attractive addition to Woodside’s portfolio of high-quality producing assets in the Gulf of Mexico. “Trion is a valuable resource with a mature development concept. Our strong balance sheet and disciplined approach enable us to invest in opportunities such as Trion, expanding our global portfolio and delivering long-term value. This development leverages Woodside’s proven expertise in deepwater project execution.

Trion has an expected carbon intensity of 11.8 kgCO2-e/boe average over the life of the field, which is lower than the global deepwater oil average.

“We have considered a range of oil demand forecasts and believe Trion can help satisfy the world’s energy requirements. Two-thirds of the Trion resource is expected to be produced within the first 10 years after start-up,” said O’Neill.

(责任编辑:黄振 审核:蒋文娟 )